What is financial Elder Abuse?

Financial elder abuse, or elder fraud, is defined as wrongfully defrauding a person, 65 years old, or older, out of money or property. Financial elder abuse is rampant, particularly in California. According to the National Center on Elder Abuse, California is home to about 660,000 new cases of financial elder abuse every single year. Los Angeles County’s Adult Protective Services, performed a survey and found that 26% of their clients said they were taken advantage of financially.

Financial elder abuse typically occurs in the shadows. Tragically, it is all too often perpetrated by the victim’s most trusted confidants and advisors.

Financial elder abuse occurs in many ways. People misuse funds, extract “gifts”, and outright steal money or property from unsuspecting, older victims. Account information is deceitfully extracted. Checks are stolen, pressured, or forged. Money is misappropriated from checking accounts, retirements, pensions, trusts, and social security. Valuable assets like homes, rentals, investments, and cars can be occupied, used, taken over, or granted title, with, or without, undue influence.

Financial elder abuse typically occurs in the shadows. Tragically, it is all too often perpetrated by the victim’s most trusted confidants and advisors. Victims are too often the subject of undue influence from relatives or caregivers because they are so dependent on these people to care for their daily needs.

California has laws that protect elders from financial abuse. For elderly people, who are the victims of financial elder abuse, Courts provide several remedies. Victims of elder abuse can recover the money or property which has been taken from them. Victims can also recover attorney’s fees, and even punitive damages under some circumstances.

How can I spot financial elder abuse?

Spotting financial elder abuse is not always easy. But, there are certain things you can look for if you think that you are, or someone you love is, the victim of financial elder abuse. Typical evidence of financial elder abuse includes things like:

- Suspicious banking activity (wire transfers to outside accounts);

- Suspicious credit card purchases (lots of Amazon or iTunes gift cards);

- Signatures on checks that do not resemble the elder person’s signature;

- Legal documents like trusts, or wills, signed without disinterested witnesses;

- Legal documents like trusts, or wills, that make sudden changes to beneficiaries to benefit the people caring for the elder (caregiver now the beneficiary instead of the kids);

- Legal documents like wills, trusts, or power of attorney being signed by the elder when he or she doesn’t seem to have the capacity necessary to make informed decisions about such things;

- Checks written out to “cash” being negotiated by an elder’s caretaker;

- Checks signed by the elder, but filled out by someone else (especially if they’re written out to names of people you do not recognize);

- New activity in dormant accounts (brokerage accounts suddenly showing lots of movement);

- Flurries of activity in regular accounts (credit cards only used for recurring payments suddenly being used to purchase other things);

- Expensive or extraordinary gifts (jewelry, cars, etc.);

- Checks or credit card transactions made out to direct mail, or telemarketing promotions (PayPal Etsy shops, and additional “insurance” are often beneficiaries);

- Contributions to new or different religious or non-profit causes (a devote Catholic suddenly giving large sums of money to that new “church” down the street);

- New caretakers, or “advisors” being added to deeds for real property, or accounts like bank accounts;

- Sudden new investments in time shares, real estate property, annuities or financial products (often coinciding with a new financial advisor);

- Taking on large real estate loans to finance “investments” or gifts;

- Taking on sudden “reverse mortgages” when they seemed to be getting along just fine without;

- Recent “caretakers”, “friends”, “companions”, “acquaintances”, or “long-lost relatives” suddenly appearing, or getting involved;

- Any of those people taking curious levels of interest in the elder’s financial matters; and/or

- Any contracts signed by the elder without review of independent counsel.

Financial elder abuse claims may be brought against suspects by the elder, or if the elder is incapable of bringing the action, it may be brought by a conservator, trustee, someone with power of attorney, or a person legally appointed as a guardian. If the elder has died, the elder abuse action may be brought by the personal representative appointed by will or the court, a trustee, or if the representative, or trustee, are the suspected abusers, it can be brought by any “interested party” including heirs, children, spouses, creditors, or beneficiaries.

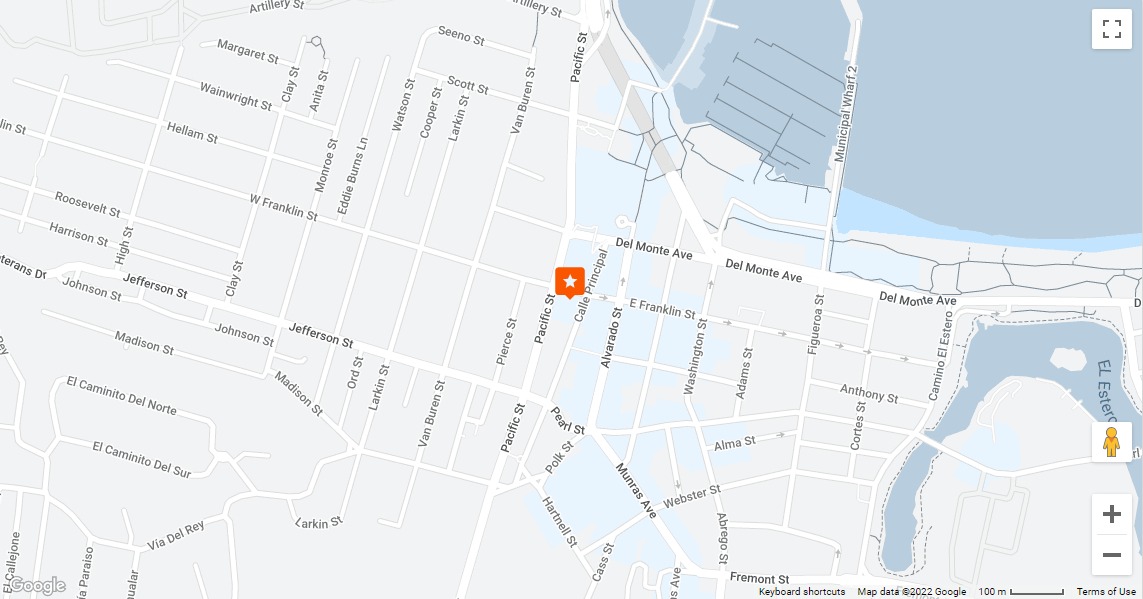

If you suspect that you, or a loved one, is the victim of elder financial abuse, please fill out our free, confidential, case evaluation form. The form goes straight to John McCarthy’s inbox. John makes it a point to review and respond to every inquiry, usually within 24 hours. If you need immediate help, the State Bar of California oversees lawyer referral services. You can find them here: https://www.calbar.ca.gov/Public/Need-Legal-Help/Using-a-Certified-Lawyer-Referral-Service/Certified-Lawyer-Referral-Services-Directory. Even if we’re not in a position to take on you case, we want to get you headed in the right direction. You can find out more here: https://www.courts.ca.gov/1058.htm. We are dedicated to fighting for people’s rights, and helping them get the justice they deserve.

OUR FAST, FREE, CONFIDENTIAL, CASE-EVALUATION FORM IS DESIGNED SO YOU CAN TELL YOUR STORY, DIRECTLY TO JOHN

START AN EVALUATIONYour responses will go straight to John’s inbox. John will review and respond by the end of the business day. If John thinks he can help, he’ll email you a link to schedule a free consultation with him. If John doesn’t think he can help, he’ll email you resources to help you understand the law, find a qualified lawyer to help you, and take steps to protect your rights. No waiting around.